Lot size on XM determines the volume of a trade and directly impacts the potential profit or loss. It helps traders control their risk by choosing how much they want to invest in each trade. By selecting an appropriate lot size, traders can manage their exposure to the market and tailor their trading strategy according to their account size and risk tolerance.

When trading on XM, understanding lot size and trading volume is essential for effective risk management and maximizing profits. Lot size determines the amount of the asset you buy or sell, while volume reflects the overall activity in the market. In this article, we’ll explain these concepts clearly and show you how to use them to make smarter trading decisions on XM.

What Is Lot Size in Forex?

In learn trading, lot size refers to the number of currency units you are buying or selling in a single trade. It determines the volume of your trade and ultimately how much you profit or lose when the market moves.

Here are the four common types of lot sizes:

- Standard Lot = 100,000 units

- Mini Lot = 10,000 units

- Micro Lot = 1,000 units

- Nano Lot = 100 units (less common)

A larger lot size increases both potential profit and risk, while a smaller lot size offers more controlled exposure—perfect for beginners or small accounts.

Which Lot Sizes Does XM Support for Forex Trading?

XM offers flexible lot sizes across multiple account types, making it suitable for both new and professional traders.

Lot Sizes by XM Account Type:

- Micro Account: 1 micro lot = 1,000 units (1 lot = 1,000 base units)

- Standard Account: 1 standard lot = 100,000 units

- XM Ultra Low Account: Available in both micro and standard formats

- Shares Account: Lot sizes vary by individual stock (only available in USD)

This flexibility allows traders to scale their positions based on capital size, strategy, and market conditions—especially when reacting to forex market movers like economic reports or central bank decisions that cause sudden volatility.

How Does XM Lot Size Compare to Other Forex Brokers?

When compared to other brokers, XM stands out for its beginner-friendly lot size structure:

| Feature | XM | Typical Broker |

| Minimum lot size | 0.01 (Micro) | 0.01–0.1 |

| Nano lot support | Not offered | Rare |

| Lot size by account type | Yes | Often fixed |

| Scalability for beginners | High | Moderate |

With XM, even traders with as little as $5 can access the market using micro lots, while other brokers may require larger capital for the same flexibility.

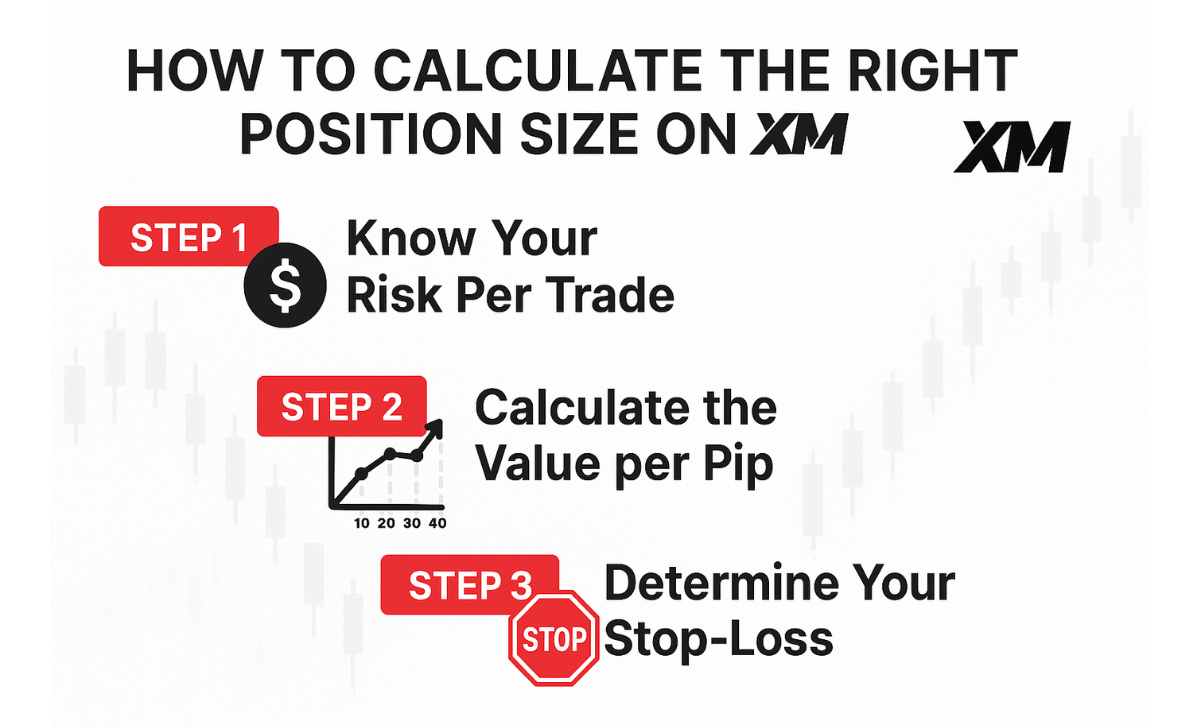

How to Calculate the Right Position Size on XM

Choosing the correct lot size is critical for effective risk management. Here’s how to calculate it:

Step 1: Know Your Risk Per Trade

A general rule is to risk no more than 1–2% of your trading capital on a single trade.

Step 2: Calculate the Value per Pip

- 1 standard lot = $10 per pip (for most USD-based pairs)

- 1 mini lot = $1 per pip

- 1 micro lot = $0.10 per pip

Step 3: Determine Your Stop-Loss

Multiply your pip risk by pip value and adjust your lot size accordingly.

Example:

- Capital: $1,000

- Risk per trade: 2% = $20

- Stop loss: 50 pips

- Lot size: $20 ÷ (50 pips × $0.10) = 0.4 micro lots

Understanding this process is a practical application of how forex works, especially when it comes to managing risk and capital allocation. XM also provides built-in calculators on its platform to simplify this process.

Does XM Adjust Lot Sizes Based on Account Type or Asset Class?

Yes. XM tailors lot sizes based on account type and instrument to ensure suitable exposure for every trader.

- Forex pairs use standard, mini, or micro lots.

- Commodities and indices have fixed contract sizes, not traditional lot formats.

- Share CFDs use lots based on actual stock units (e.g., 1 lot = 1 share).

This smart adjustment by XM allows traders to better control their risk depending on what they’re trading.

How to Choose the Best Lot Size Based on Capital and Risk Tolerance

Here are some practical guidelines:

| Account Size | Recommended Lot Size | Risk Level |

| $100–$500 | 0.01 (Micro) | Low |

| $500–$1,000 | 0.01–0.05 | Low–Medium |

| $1,000+ | 0.1+ (Mini or Std) | Medium–High |

Tips:

- Small accounts should stick to micro lots to preserve capital.

- Avoid over-leveraging even when using small lot sizes.

- Use XM’s demo account to test lot sizes and strategies in a risk-free environment.

Lot size is more than just a technical setting—it’s a core element of risk management and trading psychology. XM simplifies the process by offering flexible lot sizes, platform tools for calculation, and account options that suit every type of trader.

If you want to understand the company behind these features, visit XM’s About Us page to learn about our vision, regulation, and support for global traders.

Whether you’re starting with a few dollars or managing a large portfolio, understanding and controlling your lot size is essential to long-term success. With XM’s user-friendly environment, it’s easier than ever to choose the right position size based on your goals and risk profile.

Darius Elvon is a financial content strategist and editor with a strong focus on clarity and accuracy. He crafts easy-to-follow XM articles, covering promotions, trading tools, and platform updates to enhance user engagement. Email: [email protected]

Tiếng Việt

Tiếng Việt