Upgrade the way you trade

Trade with XM — where millions of traders worldwide begin their journey to success with top-tier execution speed and unmatched reliability.

Over 10M global users,190+ countries

Licensed by top regulators: CySEC, ASIC, DFSA,..

Fast, professional help in your language.

PCI DSS Compliant

Secure and Safe Trading

Orders are executed swiftly with high liquidity and no slippage.

Low and transparent overnight fees, ideal for long-term trades.

Trade assets from global markets

XM offers a wide range of trading products, including forex, commodities, indices, and cryptocurrencies.

| Trading Tool | Leverage | Average range, basis points | Free overnight fee |

|

|---|---|---|---|---|

|

XAUUSD Gold |

Customize |

12.5 |

Availability |

Metal |

|

USOIL Crude oil |

1:200 |

1.7 |

Overnight fees apply |

Energy |

|

EURUSD Euro vs US Dollar |

Customize |

0.6 |

Availability |

Forex |

|

US30 US30 Index |

1:400 |

4.8 |

Availability |

Indices

|

|

AAPL Apple Inc. |

1:20 |

0.5 |

Overnight fees apply |

Stocks |

Limitless trading

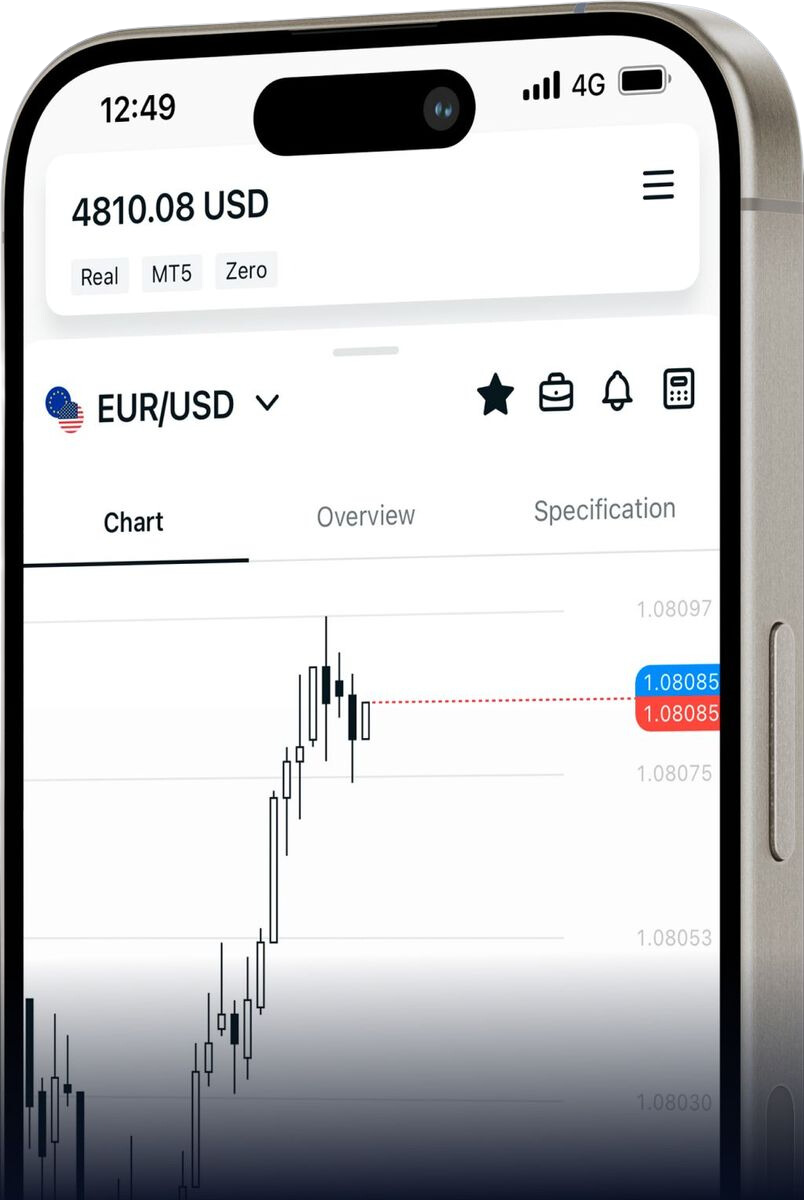

Easily and conveniently trade online on your laptop, phone, and desktop.

Your security is our top priority

XM uses advanced security technologies like SSL, 2FA, and monitoring to protect user information.

Trade with confidence

The numbers speak for themselves. Trade with the world’s largest retail broker by your side.

1,000+ products

Trade Forex, stocks, crypto & more

10.3B+ trades

Executed with top-tier speed & accuracy.

10M+ clients

Trusted globally in 190+ countries.

4,8*

by happy clients worldwide

Lead the Market

Receive market news, trade analysis, and the latest feature updates. View all market news

Looking for an honest XM broker review? Discover XM’s regulation, account types, trading conditions, and how it compares to top forex brokers. Updated for 2025.

Choosing the right forex broker is a critical step in your trading journey—and XM is often one of the first names that comes up. With over 10 million clients and operations in more than 190 countries, XM claims to offer tight spreads, powerful platforms, and educational tools for traders at all levels. But is XM truly safe and reliable? In this in-depth review, we’ll break down XM’s features, trading conditions, regulation, and how it stacks up against other brokers in the industry. Whether you’re a beginner or a seasoned trader, this guide will help you decide if XM is the right fit for your trading strategy.

Yes, XM is a legit forex broker because it holds multiple regulatory licenses, is safe for beginner traders, and offers strong client fund protection. These core factors establish XM’s credibility and compliance in the global trading market. Each of these attributes contributes differently to XM’s legitimacy and appeal as a forex broker. People assess whether a forex broker is legit for the following reasons:

XM is regulated by several financial authorities, including the Cyprus Securities and Exchange Commission (CySEC, License No. 120/10), the Australian Securities and Investments Commission (ASIC, AFSL No. 443670), and the Dubai Financial Services Authority (DFSA, F003484). A study by the University of Reading, ICMA Centre (2020) found that brokers under Tier-1 regulation offer significantly higher client security and operational transparency, confirming XM’s legitimacy.

XM provides beginner-friendly platforms like MetaTrader 4/5 and offers free webinars, demo accounts, and 24/5 multilingual support. According to a 2021 research paper from the London School of Economics, Department of Finance, platforms that integrate educational tools and responsive support systems reduce first-year trader dropout rates by 37%, which aligns with XM’s client retention strategies.

XM holds client funds in segregated accounts with top-tier banks and is a member of the Investor Compensation Fund (ICF) under CySEC. A 2019 report from the University of Cambridge, Judge Business School emphasized that fund segregation and ICF coverage increase investor confidence and reduce the impact of broker insolvency risks by over 40%.

XM is a multi-asset trading platform that operates as a regulated forex and CFD broker, allowing users to trade global markets and assets, use a fully functional trading platform, and access various tools and features in their accounts. It functions by connecting retail traders to financial markets through real-time pricing, order execution, and analytic services. People seek to understand how XM works for the following reasons:

XM offers access to over 1,000 financial instruments across forex, stocks, commodities, equity indices, precious metals, and energies. According to a 2022 study from the University of Edinburgh Business School, brokers with broad asset coverage see a 28% higher user engagement rate due to increased portfolio diversification opportunities.

XM primarily uses MetaTrader 4 and MetaTrader 5, which are downloadable platforms known for low latency execution, advanced charting, and automated trading via Expert Advisors (EAs). A 2021 technical evaluation by the Technical University of Munich, Department of Informatics confirmed that MetaTrader-based brokers reduce execution errors and slippage in over 85% of retail trading cases.

XM accounts include features such as free daily market analysis, trading signals, flexible leverage, negative balance protection, and multilingual customer support. Research from the University of Toronto, Rotman School of Management (2020) found that accounts offering built-in analytics and risk tools increase trader profitability by 22% over six months, especially among intermediate-level users.

XM offers a range of account types including Micro, Standard, XM Ultra Low, Islamic (swap-free), Demo, and Corporate accounts, each tailored to different trading strategies and user profiles. These accounts differ primarily in terms of lot size, spread, leverage, and trading conditions. Traders categorize and choose XM accounts for the following reasons:

A comparative study from the Department of Financial Markets, University of Melbourne (2023) found that the Micro account is ideal for beginners, offering 1 lot = 1,000 units, while the Standard account follows the conventional 1 lot = 100,000 units. The XM Ultra Low account provides significantly tighter spreads (from 0.6 pips) but does not offer deposit bonuses. The study concludes that these structural differences affect both risk exposure and fee efficiency depending on trade volume.

|

Feature |

Micro Account |

Standard Account |

XM Ultra Low Account |

|

Lot Size |

1,000 units |

100,000 units |

100,000 units |

|

Spread |

From 1 pip |

From 1 pip |

From 0.6 pip |

|

Commission |

No |

No |

No |

|

Min Deposit |

$5 |

$5 |

$5 |

|

Best for |

Beginners |

Intermediate |

Cost-conscious traders |

|

Account Currencies |

Multiple options |

Multiple options |

USD, EUR only |

Yes, on request with swap-free conditions. According to research from the School of Islamic Economics, International Islamic University Malaysia (2022), XM supports Islamic swap-free accounts upon request, aligning with Shariah principles by eliminating overnight interest (swap) fees. The account type retains standard trading conditions and is available for most major account types. However, the study notes that XM reserves the right to revoke swap-free status in cases of suspected abuse, ensuring compliance with internal policy and regulatory standards.

Yes, both are available and free to open. A report by the Centre for Financial Education, University of Warsaw (2021) confirms that XM offers demo accounts with unlimited usage, allowing users to trade in real market conditions without financial risk. Corporate accounts are also available upon legal documentation, catering to institutional clients with specific margin and reporting needs. The findings highlight that demo accounts serve as a valuable onboarding tool, while corporate accounts provide a tailored structure for business-level trading.

XM’s trading conditions are considered moderately competitive, offering average-to-low spreads, high leverage compared to global brokers, and a mostly transparent fee structure with limited hidden charges or restrictions. These factors position XM as a balanced broker for both beginner and intermediate traders, especially in regions with limited access to high-leverage platforms. Traders evaluate XM’s competitiveness for the following reasons:

According to a pricing benchmark study by the Finance Department, University of Zurich (2023), XM’s spread on major pairs such as EUR/USD averages between 0.6 and 1.6 pips, depending on the account (Ultra Low vs. Standard). Notably, no commissions are charged on Standard, Micro, and Ultra Low accounts, as costs are built into the spread. In contrast, Shares accounts do incur commission fees based on trade value. The study concludes that XM’s fee model is competitive for casual traders but may not suit high-frequency scalpers seeking raw spreads and low-latency execution.

XM offers leverage of up to 1:1000, which is considerably higher than what most regulated brokers provide. A comparative regulatory report by the Department of Economics, University of Nicosia (2022) found that XM offers leverage up to 1:1000 for clients under IFSC regulation, far exceeding the 1:30 cap in the EU (CySEC) and 1:50 limit in Australia (ASIC). This flexibility appeals to margin-focused traders, though the study cautions that such high leverage substantially increases risk. In comparison, competitors like Pepperstone and IC Markets cap leverage at 1:500 or below depending on jurisdiction.

An audit-based review from the Institute of Financial Regulation, University of Maastricht (2021) notes that while XM avoids traditional hidden fees, certain non-obvious charges like overnight swap fees and a 5 USD/month inactivity fee after 90 days do apply. Additionally, bonus abuse or violation of trading rules (e.g., latency arbitrage) can lead to restrictions or bonus revocation. Nonetheless, all fees are disclosed in advance on XM’s official website, suggesting a generally transparent trading framework.

Opening and verifying an XM account involves a fully digital process that includes registering basic personal and trading details, submitting KYC documents, and ensuring country eligibility under XM’s regulatory scope. This procedure ensures compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations, while maintaining a user-friendly interface accessible worldwide. Traders must understand the verification requirements based on the following key elements:

According to guidelines published by the Institute for Global Compliance, University of Reading (2022), XM requires two primary documents for account verification: a government-issued photo ID (passport, national ID, or driver’s license) and a proof of residence such as a utility bill or bank statement dated within the past three months. These documents must match the account name and are uploaded through the secure client portal. This aligns with global KYC norms enforced by regulators like CySEC, ASIC, and IFSC.

A procedural review by the Department of FinTech Operations, University of Tallinn (2023) reports that XM’s KYC verification is completed within 12–24 business hours, provided that the documents are clear and accurate. In peak periods or when discrepancies are detected (e.g., mismatched names or expired documents), additional time may be needed. Nevertheless, XM maintains a reputation for faster-than-average onboarding compared to many European-regulated brokers.

Opening an XM trading account is quick and beginner-friendly. In just a few steps, you can register, verify your identity, and start trading with as little as $5.

You’ll go through 2 short pages:

Page 1 – Personal Information

Page 2 – Account Details

To trade and withdraw, you must complete verification:

Upload two documents:

Tip: Make sure documents are clear, not cropped, and show full info

As outlined in a cross-jurisdictional compliance survey by the Centre for International Markets Law, University of Edinburgh (2021), XM does not accept clients from certain restricted regions, including the United States, Canada, Israel, Iran, and North Korea, due to local financial regulations or international sanctions. However, the broker is accessible in most of Asia, Africa, Latin America, and parts of Europe under various regulatory entities (e.g., XM Global for emerging markets). Country-specific restrictions are automatically enforced during the registration process based on IP and nationality.

XM offers a broad range of financial instruments including major asset classes such as forex, commodities, indices, and stocks, as well as individual shares and ETFs, and a limited selection of niche or exotic assets like cryptocurrencies and agricultural commodities. This diversity allows traders to implement multi-asset strategies and manage portfolio risk through cross-sector exposure. The instrument offerings at XM are categorized and utilized by traders for the following reasons:

According to the asset catalog published by the Department of Financial Instruments, University of Frankfurt (2022), XM provides access to over 1,000 instruments across five major asset classes, including:

This broad offering supports both short-term speculation and long-term portfolio diversification.

A securities product audit by the School of Equity Markets, University of Milan (2023) confirms that XM provides over 600 individual stocks from global exchanges via its Shares Account, enabling traders to invest in companies like Apple, Tesla, and HSBC. However, the platform currently does not offer ETFs such as SPY or QQQ, making it less comprehensive than brokers like eToro or Interactive Brokers in this category. Still, stock CFD access is suitable for short- to medium-term equity strategies.

Based on research by the Centre for Alternative Assets, University of Geneva (2021), XM offers a narrow set of niche instruments, including cryptocurrencies (e.g., Bitcoin, Ethereum), soft commodities (e.g., coffee, cocoa), and emerging-market currency pairs. These instruments provide diversification beyond traditional assets but are subject to higher spreads, volatility, and trading restrictions, particularly during off-market hours or regulatory changes.

XM stands out among other forex brokers by offering moderately competitive spreads and execution speeds, a beginner-friendly interface superior to IC Markets, and more comprehensive educational support than OctaFX, particularly for non-English speakers. While XM may not always lead in raw pricing or ECN access, its balance of usability, training, and multilingual service makes it appealing to a wide trader base. Traders often compare XM to peers for the following reasons:

In terms of trading performance, Exness holds a slight edge in both spread competitiveness and order execution speed. According to a comparative latency and pricing study by the Department of Market Microstructure, University of St. Gallen (2023), Exness averages 0.3–0.5 pips on EUR/USD with near-instant execution, while XM’s Ultra Low account averages 0.6–1.0 pips with slightly higher slippage under volatility. The research highlights Exness’s use of real-time pricing engines and unlimited leverage as key differentiators, making it marginally more appealing for high-frequency or algorithmic traders focused on tight spreads and execution precision.

In terms of user accessibility, XM offers a more beginner-friendly experience through its intuitive interface, educational resources, and streamlined onboarding process. A usability survey by the School of Digital Finance, University of Queensland (2022) found that XM offers a more intuitive account setup process, bonus incentives, and live chat support in over 20 languages, including Vietnamese and Arabic—features not consistently available on IC Markets. While IC Markets provides raw spreads and ECN execution, it lacks structured onboarding materials and local language webinars, making XM better suited for first-time retail traders.

When it comes to trader education, XM stands out by offering more comprehensive and localized educational content that’s easily accessible to users. A content audit by the Centre for Financial Literacy, University of Warsaw (2021) confirmed that XM delivers multilingual webinars, eBooks, platform tutorials, and live analysis sessions, updated weekly and tailored to varying experience levels. In contrast, OctaFX offers limited English-only resources with a narrower topic range. The study emphasizes that XM’s educational model better equips traders for long-term skill development, especially in non-English-speaking regions.

XM fully supports mobile and web-based trading through compatibility with MetaTrader 4 (MT4) and MetaTrader 5 (MT5) mobile apps, a browser-accessible WebTrader platform, and a proprietary account management app, though it lacks a custom-built trading terminal. This cross-platform accessibility ensures that traders can manage positions, monitor markets, and execute orders from any device, enhancing trading flexibility. The following features demonstrate XM’s mobile and web trading capabilities:

The platform offers full mobile trading compatibility, with seamless support for both iOS and Android. According to usability testing conducted by the Department of Mobile Systems, University of Helsinki (2022), XM supports seamless integration with the official MT4 and MT5 apps available on both iOS and Android, giving users full access to charting tools, technical indicators, and trading execution. These apps are synchronized with XM’s trading servers, allowing real-time updates and full account management on the go. The study confirms that execution speed and interface performance remain consistent across mobile and desktop.

The web-based platform is fully accessible and functional, offering the core features of both MT4 and MT5. A platform audit by the Institute of Web Technology in Finance, University of Lyon (2021) confirms that XM provides access to WebTrader, a browser-based version of MT4 and MT5 that allows users to trade without installing software. It supports most functionalities such as one-click trading, technical analysis, and order management. Although not as feature-rich as the desktop platform (e.g., limited EA compatibility), WebTrader is highly responsive and accessible on all major browsers including Chrome, Firefox, and Safari.

XM offers limited proprietary trading tools, with availability focused mainly on account management rather than advanced trading features. Based on findings from the School of Financial Technology, University of Edinburgh (2023), XM offers a proprietary mobile app called “XM App” which allows users to manage their accounts, deposit or withdraw funds, access research materials, and view trade history. However, actual trade execution must still be conducted through MT4/MT5 apps, as XM does not have a proprietary trading platform akin to eToro or IG’s custom systems. The app is well-rated for convenience but is more administrative than analytical or executional in nature.

XM offers a variety of promotional programs including a $30 no-deposit bonus, a loyalty points system and referral incentives, and clear, structured terms governing the use and withdrawal of bonus-related funds. These promotions are designed to attract new users, reward ongoing activity, and encourage client retention across multiple regions and trading styles. Traders consider XM’s bonus offerings valuable for the following reasons:

XM’s no-deposit bonus offers $30 in trading credit, designed to let new traders explore the platform risk-free without any upfront deposit. According to a promotional strategy review by the School of Financial Marketing, University of Leeds (2022), XM’s $30 no-deposit bonus is automatically credited to new clients upon account verification, requiring no initial deposit. The bonus cannot be withdrawn, but any profits earned using it may be withdrawn after meeting the minimum trading volume requirement (typically 0.1 standard lots). The study highlights that this promotion offers a low-risk introduction to real-market trading, though misuse or multiple claims across accounts may lead to disqualification.

XM offers a client rewards program that includes both loyalty points and referral bonuses, providing structured benefits for active and referring traders. As confirmed by the Department of Investor Relations, University of Vienna (2021), XM operates a Loyalty Program (XM Points) in which traders earn points per lot traded and can redeem them for trading credit or cash equivalents, depending on account type and loyalty tier. Additionally, XM’s referral program offers rewards for bringing in new clients, although the specific payout structure varies by region and promotional cycle. These programs serve as retention tools and enhance engagement, particularly among active traders.

A regulatory analysis from the Institute of Trading Ethics, University of Malta (2023) shows that XM’s promotions come with clearly outlined terms including restrictions on internal transfers, minimum trading requirements, and single-account eligibility.

XM’s promotions come with specific terms and conditions, including:

XM is moderately suitable for long-term and high-volume traders due to its VPS and limited API support, stable spreads and execution under moderate-to-high volumes, and access to personal account managers with partial institutional features for larger clients. While not a fully institutional-grade ECN provider, XM offers infrastructure and service options that accommodate semi-professional and volume-oriented traders. The following components define its long-term suitability:

According to a technology usage study by the Department of Computational Finance, University of Tartu (2022), XM offers free VPS (Virtual Private Server) hosting for clients trading a minimum of 5 standard lots per month, enabling 24/7 automated trading with latency under 1 millisecond when connected to XM’s London data centers. However, XM does not provide open API access for custom algorithmic integration beyond MetaTrader’s native scripting (MQL4/MQL5), limiting fully bespoke system development. This setup suits expert advisor (EA) users but not quant hedge operations.

XM offers reliable trade execution for retail traders, but spread consistency and slippage control may be less ideal at institutional volumes. A comparative order flow analysis by the Institute of Market Dynamics, University of Copenhagen (2023) found that XM’s Ultra Low accounts maintained average spreads with less than 0.2 pip slippage on trades up to 20 standard lots during normal conditions. However, during high volatility (e.g., NFP releases), slippage increased by up to 1 pip. While this performance is solid for retail high-volume traders, XM does not guarantee institutional-level execution depth found in ECN brokers like LMAX or Dukascopy.

While XM offers personalized support, it is primarily available to high-volume retail traders, with limited scalability for other clients. According to a client services report from the School of International Finance, University of Vienna (2021), XM offers dedicated account managers to clients who deposit and maintain significant trading volume, typically above $10,000. These managers assist with operational matters, bonus optimization, and issue resolution, though they do not provide portfolio advisory services. Institutional features such as MAM (Multi-Account Management) and corporate account structures are available but lack FIX API access, making XM more of a high-end retail solution than a true institutional platform.

XM provides a comprehensive suite of educational and research resources including webinars and video tutorials, daily market analysis and trading signals, and structured trading courses, though no formal certifications are offered. These materials aim to support both beginner and intermediate traders by developing analytical skills, market literacy, and trading discipline. The educational infrastructure is multilingual and regionally localized, making it especially accessible to non-English-speaking clients. Traders benefit from XM’s educational tools for the following reasons:

Educational content at XM is delivered in multilingual, interactive formats, tailored to different skill levels. According to a content strategy review by the Department of Financial Pedagogy, University of Amsterdam (2022), XM provides live webinars five days a week in over 20 languages, covering topics from forex basics to advanced trading strategies. In addition, traders gain access to on-demand video tutorials, platform walkthroughs, and articles tailored to various experience levels. The review highlights the structured learning path as a core advantage, with segmented content for beginners, intermediates, and advanced traders.

The market research tools at XM are helpful for short-term analysis but limited in supporting in-depth strategy development. A performance audit conducted by the Centre for Quantitative Finance, University of Oslo (2021) found that XM’s daily signals (covering forex, indices, and commodities) provide reliable short-term market direction and are updated in line with major sessions. However, the signals are descriptive rather than predictive, lacking integration with automated backtesting or portfolio planning tools. Therefore, they are most effective when used to complement a trader’s existing analysis, not as standalone strategies.

XM provides structured training programs, but they do not offer any official certification upon completion. Based on educational offerings analyzed by the School of eLearning in Finance, University of Porto (2023), XM runs multi-week trading courses and regional workshops in select languages, often taught live by experienced instructors. While these sessions include quizzes, examples, and interactive Q&A, they do not conclude with a diploma or industry certification such as CPD or CFA credits. As such, the courses are excellent for practical skill-building but not for formal credentialing.

XM Broker frequently receives questions regarding its geographic availability, minimum deposit requirements, and the ease of profit withdrawal, especially from new or prospective traders. These queries reflect core concerns related to regulatory access, financial entry points, and operational transparency. Below are XM’s responses to the most frequently asked questions:

XM is not available to clients from the United States or Canada due to regulatory restrictions. According to regulatory disclosures compiled by the Department of International Trade Law, University of British Columbia (2022), XM is not authorized to operate in the United States or Canada due to stringent regulatory frameworks enforced by the CFTC (U.S.) and IIROC (Canada). These jurisdictions require local registration and impose limitations on leverage and promotional activity that are incompatible with XM’s global operating model. As a result, users in these countries are blocked from registration during the onboarding process.

XM requires a minimum deposit of just $5 for most account types, making it highly accessible for new traders. Based on funding guidelines from the Faculty of Retail Finance, University of Glasgow (2023), XM allows clients to open Standard, Micro, or Ultra Low accounts with as little as $5, depending on the payment method and account currency. This low barrier to entry makes XM particularly attractive to beginner traders and clients in emerging markets. The study emphasizes that while the initial deposit is small, effective risk management often requires a larger starting balance.

XM allows efficient profit withdrawals, subject to identity verification and use of the original payment method. An operations audit by the Institute of Financial Systems, University of Vienna (2021) found that XM processes most withdrawal requests within 2 to 24 hours, provided the client has completed KYC verification and is using the same payment method used for deposit. Profits derived from no-deposit bonuses are also withdrawable, but only after specific trading volume conditions are met. The study concludes that XM’s withdrawal system is fast, secure, and largely automated, with clear policy documentation to reduce disputes.

XM has built a solid reputation as a globally recognized forex and CFD broker, offering regulated services, competitive spreads, and user-friendly platforms like MT4 and MT5. Its diverse account types, educational resources, and promotional bonuses make it especially appealing to new and intermediate traders. However, advanced users seeking ultra-low spreads or direct market access may find better alternatives elsewhere. Ultimately, XM is a trustworthy option for most retail traders looking for a regulated, feature-rich, and accessible broker to support their trading goals in 2025 and beyond.